CVW finds out the thoughts of the Commercial Director of EMS-FP&S, Robert Molloy, on the CV parts aftermarket.

Q. How is the CV parts aftermarket changing?

Robert Molloy (RM): Extended opening hours and 24-hour operation are now the norm for many CV workshops in the UK. That means distributors have had to change, too, to continue servicing those customers.

More customers are ordering online. As distributors, we’ve had to respond so our customers can order from us when it suits them, not just when we are open. Workshops want the parts there as early as possible so downtime is reduced.

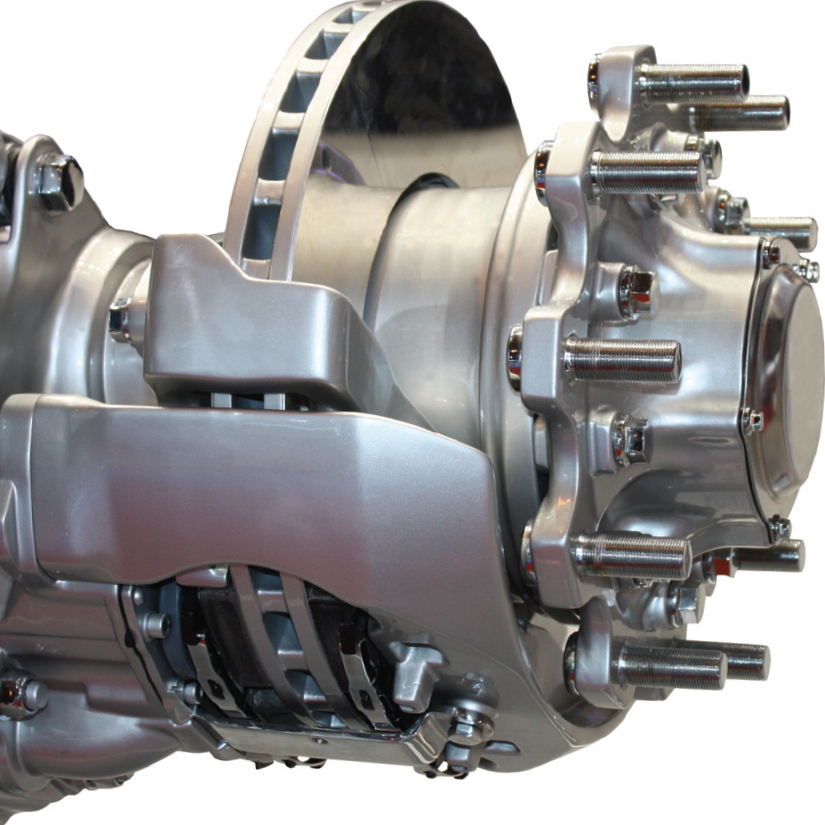

To make it faster for the customer to identify the part they need, we create a dedicated account for each customer and for each vehicle. Inputting the chassis number of the vehicle produces a dropdown menu, which will show the list of all the replacement parts for that vehicle. The menu will also prompt customers when they need other components to complete the repair – bolts for a disc brake replacement, for example.

Q. Why are we seeing consolidation amongst distributors?

RM: The CV aftermarket in the UK is in a transition period: OEMs are competing for all-makes business, more operators are buying online, and smaller family-run parts distributor companies have merged as their owners and founders are of retirement age. Now, large European parts distributor groups with their enormous purchasing power have entered the UK market.

EU Block Exemption rules prevent OEMs from restricting who can supply replacement parts, so parts distributors can now access the same information as dealers. They can precisely identify the truck model and the exact part required from the chassis number.

Distributors and operators both gain. To help our customers get vehicles back into service as quickly as possible, we deliver all three versions of the same part and then make sure we have the unwanted ones returned. It also meant we carried more stock than necessary, adding cost to the business. Being able to precisely identify the part allows us to manage our own stocks more closely, helping us to be competitive on price.

However, the loss of a captive aftermarket has prompted the OEMs to invest in all-makes parts brands, competing directly with independent distributors. OE dealer networks have targeted the all-makes parts market with aggressive pricing strategies and by sourcing parts from Tier 2 and 3 component manufacturers who are not OE suppliers.

This strategy is recognition that operators will not pay for premium parts in all situations – when a truck is about to be de-fleeted, for example.

However, whilst buyers are no longer focused solely on cost and off-the-shelf availability, nor do they want to compromise on safety. So, the market demand is for fit-for-purpose parts with a warranty.

Customers will expect that their parts suppliers can vouch for the parts supplied. OEMs do have the capacity to test the parts they source, but only some distributors do; EMS-FP&S is one that does. The aftermarket division of the BPW Group tests all parts it sources. The test criteria are set to ensure they meet or exceed the relevant regulations – ECE 90 for brakes, for example.

Q. Is there still demand for imprest stock?

RM: Yes, indeed there is. Imprest stock gives reassurance that downtime won’t be lengthened by unavailability of parts and is particularly helpful for workshops in remoter locations.

To make life even easier, EMS-FP&S has

introduced a barcode-based RFID stock-control system. All the parts on site are tracked (via an RFID barcode) from when they are placed in store to when they are removed and placed on a vehicle. The customer and our own records are automatically updated.

It eliminates the potential for disputes over delivery and use dates, location, and so on, and it means we can be much more proactive in managing imprest stores for our customers. We can remotely monitor stocks and usage, so we and our customers have a 365-day view of imprest stocks, which we can review weekly or monthly.

Our support team don’t have to drive to a customer premises simply to carry out a routine stock check, and that can involve a lot of time when customers are located some distance from the nearest branch.

Q. What changes do operators expect to see in future?

RM: We have already become more proactive with our customers to offer cost-down savings. Customers want to know what their parts costs are and how they can save without compromising safety or reliability. We already offer bespoke reports based on the chassis number so, for example, we can report lifetime costs for a vehicle.