Operators need to stay ahead of the curve on low-emission freight vehicles or risk being left behind, says Venn Chesterton, ULEV Innovation Lead at Innovate UK and the Low Emission Freight Trial (LEFT).

As low-emission vehicles move from prototype concept vehicles to mainstream production, more operators are considering ultra-low emission vehicles (ULEVs) as part of their normal fleet replacement programme, reported Chesterton.

“Ultra-low emission vehicles are on the road now. Some operators are actively participating in the Low Emission Freight Trial, gaining valuable insights into their costs and performance.

“It’s true we cannot be sure what will happen long-term, but what is predictable is that the writing is on the wall for diesel- fuelled vehicles, even 44-tonne trucks. In the coming years, it will be critical for businesses to know what their alternative fuel options are, and to have a strategy in place, either to introduce them to the fleet gradually over time, or to ramp up their introduction quickly. Workshops will need to ensure technicians have the right skills to service these new-generation vehicles.

“It’s time to stop automatically buying standard diesel trucks. Operators need to look at their fleet, the different types of vehicles in it, and compare them with the vehicles operators are running in the LEFT and other trials. The bandwagon is rolling and fleets need to make sure they have a place on it.”

LEFT trials

The aim of the Low Emission Freight and Logistics trials is to demonstrate new technologies and to encourage the widespread introduction of low and zero emission commercial vehicles in UK fleets. Over 200 alternatively-fuelled vehicles are participating in LEFT projects, which are funded by the Office for Low Emission Vehicles (OLEV). Electric vans and trucks, as well as gas, hydrogen and dual-fuel vehicles are being evaluated.

“Various consortia are taking part in the trials, operating these advanced technologies in real-world scenarios while capturing data. The aim is to demonstrate how those alternative fuels and technologies work in a practical environment long-term.

“Providing answers to operators’ natural caveats of what the bottom line in pence-per-mile and reliability are what the LEFT trials are all about. Operators want reliability and acceptable costs from day one – they don’t want to be field testing unproven technology.”

Capturing the data

LEFT will capture vehicle performance data over a 12-month period, so that emissions across all four seasons can be captured. The data, captured from on- board telematics boxes, will be compared with diesel-fuelled vehicles over the same period and on the same, or close to the same, operation.

“The data will give us the precise energy consumption for each vehicle, which we can then extrapolate to give us the matching emissions data,” explained Chesterton. At least once during the trial period, each LEFT vehicle will undergo a chassis dynamometer rolling road test to measure its actual emissions. The first reports are expected later in 2019.

“We need to understand if there is a reduction in NOx and PM10 in the low- emission trucks. Separately, we need to know if there is any unburnt methane remaining after the combustion process in the gas trucks,” stressed Chesterton.

Alongside the hard data, the project teams will also collect ‘soft data’ via interviews with drivers and fleet managers to get a complete picture of how the alternative technologies work in practice. As well as driving experience, they’ll be collecting data on maintenance, costs, and downtime, for example.

Gas: The workshop challenge

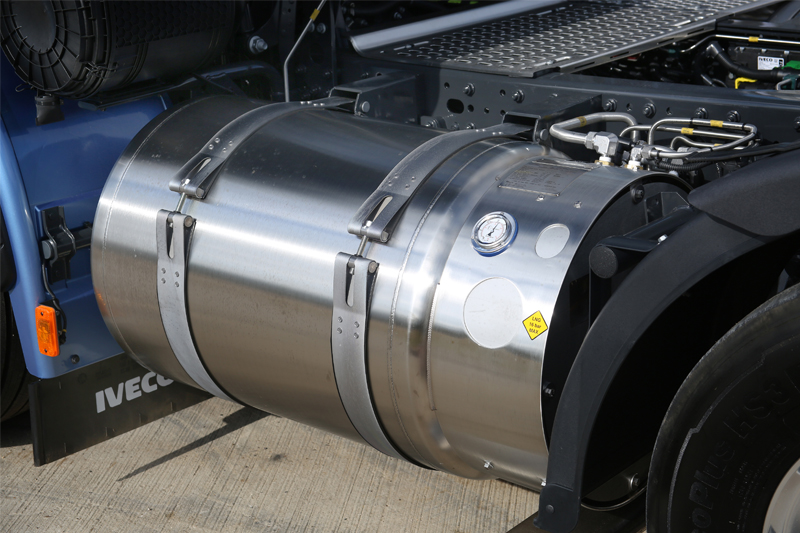

The fuel in gas engines is either Compressed Natural Gas (CNG) or Liquified Natural Gas (LNG). Both lower NOx and PM emissions without the need for complex exhaust gas treatment technology such as EGR.

The fuel types have different ignition systems. CNG gas engines use spark ignition (SI) technology similar to that in a petrol-fuelled car, while LNG engines use a small amount of diesel fuel for ignition.

Service intervals are shorter than those for an equivalent diesel-engined truck or bus, partly because the maintenance requirements are not identical. Whereas, in diesel engines it is the oil quality that matters, with CNG gas engines, it is the condition of the spark plugs that determines service intervals.

There is less soot and emissions from a gas engine compared to diesel – Scania, for example, has been able to eliminate the centrifugal oil cleaner on its nine and 13L gas engine. However, gas engines run at higher temperatures, and the heat does have an impact on oil life.

Spark plugs need regular changing and OEMs have taken a cautious approach when it comes to the durability and between- service reliability of these components to avoid unplanned downtime. Short service intervals of 30,000km were not unusual in the early days of gas engines, but manufacturers are increasing those as experience of on-road behaviour grows. Scania, for example, has increased service intervals to 45,000km for its nine and 13L engines. However, Iveco recommends changing the spark plugs at every oil change – typically, every 75,000km. Still, that’s much shorter than the 150,000km for a modern diesel engine. Mercedes-Benz recommends an oil and plug change every 60,000km or 1,200 operating hours for its gas-powered Econic refuse vehicles.

Caution is also the byword when it comes to gas-specific parts – low pressure gas filters and dump sensors will need routine replacement, say the OEMs, with routine checks on valve clearances.

Oil drain intervals are longer on LNG trucks – Volvo recommends 100,000km.

Given that most gas trucks to date are on long-haul operations, it’s not surprising that manufacturers think a mileage-based approach to servicing has potential, especially allied to on-board telematics monitoring of vehicle condition.

Brake life is predicted to be longer on CNG-fuelled trucks. Lack of engine braking means gas trucks have a retarder or intarder fitted, so there is less demand on service brakes.

Workshop safety

Any workshop planning to service gas trucks should first have a risk-assessment using the Dangerous Substances and Explosive Atmospheres Regulations 2002 (DSEAR). Safety precautions may depend on the type of fuel used: CNG is stored at an ambient temperature under high pressures, while LNG is a cryogenic gas stored at a very low (-140°C), which can cause injury if it comes into contact with the skin or eyes.

Leak-detection equipment will be required, including gas sniffer equipment, leak detection liquid, and personal protective equipment, including gloves and goggles. Technicians will have to undergo appropriate training in, for example, high pressure pipework.