ALD Automotive | LeasePlan considers eLCVs

Matt Dillon, head of commercial vehicles at ALD Automotive | LeasePlan argues that eLCVs are the way forward but mindsets need to change, infrastructure improve and incentives offered.

In December 2022, new registrations for battery electric vehicles (BEVs) overtook diesel for the first time ever, becoming the second most popular powertrain behind petrol. Many took this as the long-awaited tipping point when EVs would finally enter the mainstream. For the past few years, the EV market has gone from strength to strength, defying the odds as sale figures for other vehicles dropped against the backdrop of the pandemic and a semiconductor shortage.

But as this booming growth continues in the electric car market, are the electric light commercial vehicles (eLCVs) keeping pace?

With a 400% Google search demand increase for ‘electric vans’ since 2018 and an increase in BEV LCV registrations, it would appear that the market is also on an upward trajectory.

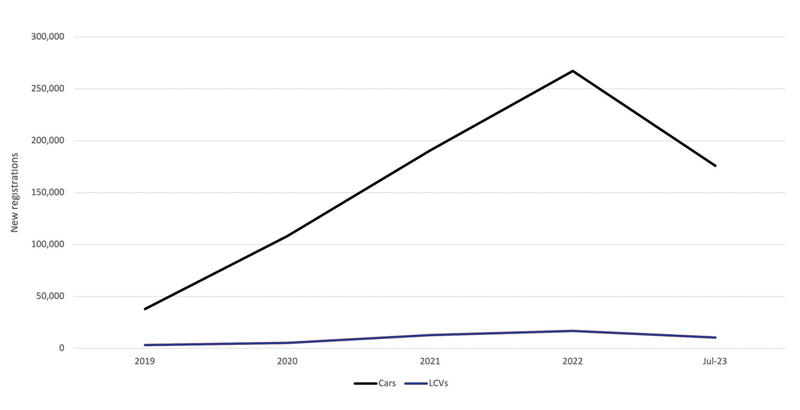

Yet, analysis of Society of Motor Manufacturers and Traders (SMMT) data shows that despite this exponential growth, the eLCV market is still lagging far behind passenger vehicles.

Since the announcement of the 2035 petrol and diesel ban and the start of the UK’s electrification plans, the van market has experienced significant transformations.

In the last four years, eLCV registrations have increased by 422% (2019 – 2022). However, in comparison, BEV registrations grew by 711% in the same period – showing a disparity in the growth of the two markets.

And whilst eLCV registrations look to be on an upward trajectory in 2023, with a 16.1% increase year-on-year (July 2022 YTD vs. July 2023 YTD), BEV passenger cars have seen an even stronger rise year-on-year of 38%.

A look behind the data…

Despite the boom, new eLCV registrations are still far behind BEV car registrations, and there are several reasons for this.

Firstly, there are higher upfront costs. In many cases, electric models are still more expensive than their petrol and diesel counterparts, leading some fleet decision-makers to view them as too pricey. This is especially true for smaller businesses with limited budgets. However, the total cost of ownership (TCO), which considers running costs, maintenance and depreciation, is typically less for eLCVs than for petrol or diesel. Although energy costs may fluctuate (or rise), the overall TCO is typically less than petrol and diesel. Therefore, by adopting a long-term mindset there are considerable savings to unlock.

Some fleet-operating businesses are concerned about electric vehicles’ range and operational suitability. eLCVs generally have a shorter driving range than ICE vehicles, making them less suitable for long-distance journeys or businesses with delivery routes outside of urban areas. The size of the battery also reduces the payload for each vehicle, which means less space for cargo. However, this is getting better all the time as battery technology improves and the range of models on the market expands. With more electric vans hitting the market, their vehicle design is also improving. Purpose Built Vehicles (PBVs) are now emerging – electric, autonomous vans that can be used to perform various tasks. Kia is one manufacturer that has announced its own PBV.

Lastly, there are still ongoing challenges around charging infrastructure. A perceived lack of chargers for EVs, particularly in more rural areas, is holding many fleets back, and while this has greatly improved in recent years, some existing charging stations aren’t suitable for larger vehicles.

What’s next for the eLCV market?

If the eLCV market is to remain on course for the 2035 deadline, we need to see continued investment from the government in the rollout of charging infrastructure across the country and the range of financial incentives available for businesses and drivers. Standardisation and accessibility are also important factors when encouraging people to make the switch, as it will ensure that every driver has the same positive experience.