Portland Analytics explores diesel prices

Oliver Nightingale-Smith of Portland Analytics explores the relationship between the price of traditional fossil-based diesel and renewable diesel over the last year, highlighting the various market dynamics affecting the price of each grade.

Prices of traditional and alternative fuels alike have been subject to considerable price volatility over the past 12 months, with shifting supply and demand economics combined with a turbulent geopolitical landscape leading to increased price sensitivity.

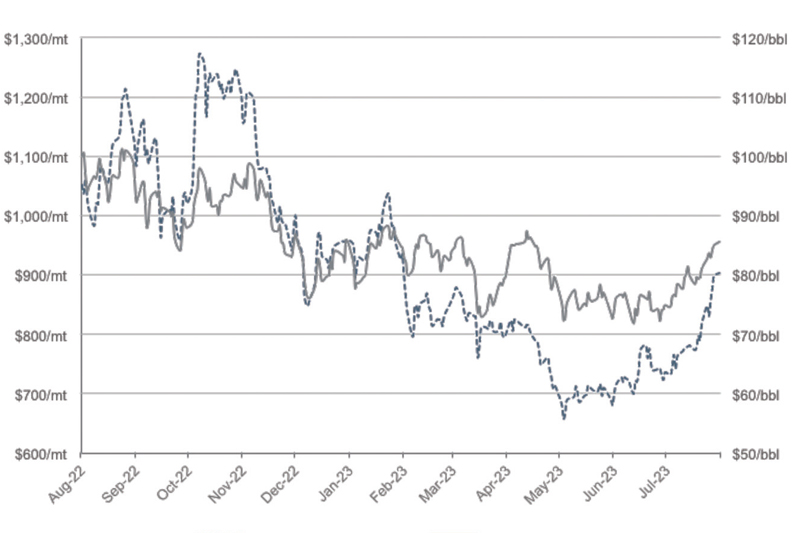

Traditional wholesale diesel pricing generally follows a similar trend to its underlying oil benchmark, Brent crude, which is used to set the price of oil in European markets. In August 2022, Brent crude was trading around the $100 per barrel (bbl) mark, falling to a low of $70/bbl in June and recovering to the mid-$80/bbl range at the time of writing. Wholesale diesel prices followed suit, declining from $1,050 per metric tonne (mt) to $650/mt on 3rd May, before rising back to around $900/mt at the end of July.

The decline in prices during the latter part of 2022 was dictated by a worsening global economic outlook, with record levels of inflation and a looming recession met with rising interest rates across several major central banks. Faltering economic recovery in top oil importing nation China caused significant demand concerns, alongside US consumer confidence dropping to an over one-year low. Despite OPEC+, the group of oil producing nations, announcing further production cuts of two million barrels per day in October causing a brief spike in prices, persistent Chinese demand woes and declining manufacturing activity in European and US economies caused prices to fall by year-end.

2023 began with increased demand optimism, largely due to signs of China’s promising economic recovery, alongside additional OPEC+ output cuts leading to an increase in oil prices in January. However, persistent monetary policy tightening led to weakened energy demand across Q1 and 2, seeing prices fall to an 18-month low in June. That said, in recent weeks, the market has been supported by supply constraints, with Saudi Arabia and Russia announcing output cuts for August, alongside heightened demand, particularly in the US which recently saw the largest week-on-week draw on oil stocks since records began.

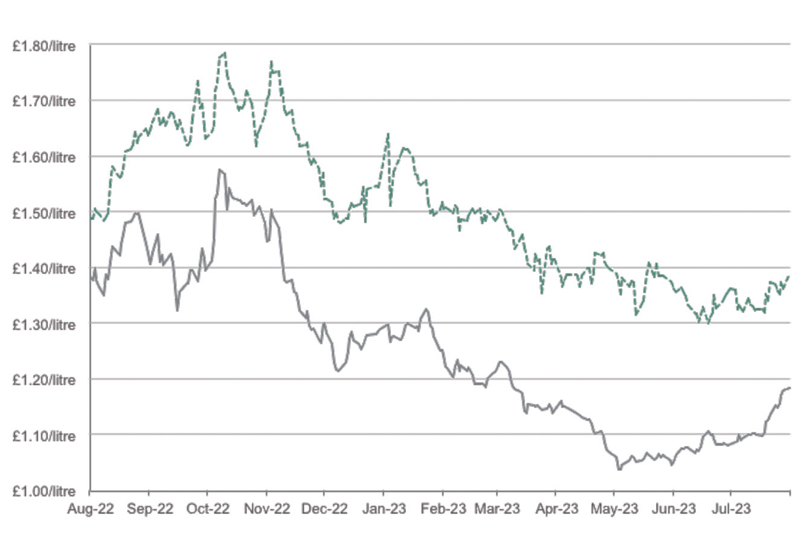

These trends have been reflected in the price of UK commercial diesel, declining by £0.21 per litre over the last year from £1.37 to a low of £1.03 in May, rising back to £1.20 at the time of writing. Alongside declining wholesale prices, pound sterling has strengthened against the US dollar, peaking at $1.31 in July, contributing to the fall in UK pricing.

Whilst the price of renewable diesel broadly follows similar trends to its fossil-based counterpart, there are additional factors affecting price, such as the availability of feedstock and the cost of compliance with carbon reduction obligations across Europe.

Meeting obligations

Renewable diesel in Europe is primarily produced through the hydrotreatment of fats and acid feedstocks, such as used cooking oil (UCO), hence it is often referred to as hydrotreated vegetable oil (HVO). The cost of UCO has fallen by around $400/mt over the past 12 months due to a combination of weak biofuels demand and stronger exports from Asia. UCO is also used as a feedstock within traditional ‘first generation’ biodiesel, e.g. UK-standard B7 (7% biodiesel blend) – weakness in the traditional diesel market therefore causes a negative impact on feedstock prices due to lower demand.

As there is currently little to no indigenous production in the UK, the wholesale price of renewable diesel is set by the European market, which is heavily impacted by the cost of meeting various carbon reduction targets within the EU. Renewable diesel can be used as a tool for fuel suppliers to meet these obligations, therefore the cost of compliance through alternative methods e.g. blending other biofuels products such as methyl ester, also affects the price.

Several countries temporarily reduced or paused biodiesel blending mandates in 2022 in response to rising prices as a result of the Russian invasion of Ukraine (e.g. Sweden has cut its obligation from 7.8% to 6% from 2024 to 2026). This has further reduced the demand for biofuels, causing prices to fall, which has seen the price of renewable diesel follow suit – over the past 12 months, Portland’s wholesale HVO index has fallen from $2,800/mt to $2,200/mt at the time of writing.

Carbon reduction legislation also impacts the price of renewable diesel for end users in the UK. The Renewable Transport Fuels Obligation (RTFO) mandates that a certain percentage of fuel suppled in the UK must be made up of renewable sources. This is traditionally met by blending fossil product with methyl ester, which generates a Renewable Transport Fuels Certificate (RTFC), used to meet the obligation.

Renewable diesel produced from waste feedstock, such as UCO, generates two RTFCs when imported to or produced in the UK. Producers/importers can use these certificates to either meet their own biofuels obligations under the RTFO, or sell them on to other obligated businesses. As a result, RTFCs have a trade value, which ultimately affects the sale price of HVO in the UK. The higher the RTFC value, the greater financial benefit HVO producers/importers receive, therefore leading to a lower differential against traditional diesel – an increase in RTFC prices has seen this narrow in recent weeks.

The combination of these factors has seen the price of renewable diesel for road use in the UK fall significantly in the last 12 months, currently around £1.45 per litre, a difference of c. £0.25 per litre vs B7 biodiesel, down from a high of c. £1.78 per litre in November.