An electric van can be a great asset for your business: green, and cheaper to run and maintain. But how practical are electric vehicles, and could they suit your business needs? Plan Insurance explains…

Purchasing costs

If EVs are still more expensive to buy than their traditionally powered counterparts, prices are starting to drop and manufacturers offer appealing finance options. In some areas, councils have also launched initiatives to help businesses make the move to electric: for example, Croydon Council has recently entered a partnership with Fleetdrive Electric to offer discounted 6-12 months leases of a Nissan eNV200 to local businesses.

MOT and Service

Electric Goods Vehicles are MOT exempt and annual servicing is generally cheaper, as there is no oil to change. Also, the electric engine is simpler, there is less risk of anything going wrong, and most issues are likely to be covered by the manufacturer’s warranty.

Charging costs

Fully charging a van overnight would typically cost £1.50 to £2, and this should give you a maximum range of around 100 miles. You would spend £15 on diesel to cover a similar mileage. Although in real life, the range covered with a full charge is more likely to be 60-80 miles (cold weather or adding a payload will affect the range), the savings are definitely appealing.

If you are a registered company, you should be able to deduct VAT for this business expense from your household energy bills. Installing a charger can cost between £149 (domestic) and £899 (commercial), with the government offering a number of incentives and funding options.

Congestion charge

Electric vehicles benefit from a total exemption. Currently at £11.50 a day in London (£21.50 for pre-Euro4 vehicles having to pay the T Charge), you could recoup the installation of a charging point in just a few weeks.

Insurance

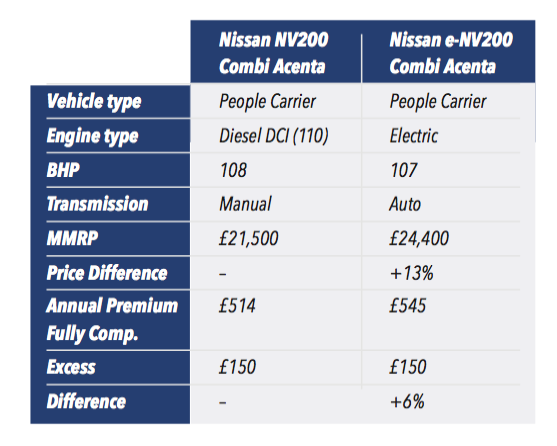

Insurers don’t have much data yet on reliability and parts prices for EVs, making it difficult to predict the frequency and cost of claims, and therefore to define premiums. However, having carried out some research, we have found that the difference in premium between traditional and electric vehicles isn’t actually as high as customers may think. Premiums are likely to go down with technology advances (e.g. cheaper batteries, better impact protection for the cells), when the number of EVs on the road increase and when more insurers offer policies for them.

Impact of limited range

In terms of savings, there is no denying that electric is the way to go. However, one of the main issues for prospective EV buyers is range anxiety.

Ranges are improving: Nissan announced an impressive 170 mile range for their new e-NV200. But in reality, environmental factors and driving style can reduce the range considerably. Cold weather, adding passengers or a payload, using the heating or air con will drain a battery much quicker. This will reduce potential savings and meaning additional charges may be required during the day.

Having to charge more often wouldn’t be such a problem, if it was easy to find a charging point. The Government is requesting that larger petrol stations in certain areas install charging points, and is working on the use of street lamps and on- street charging options. However, it will take a little while for all these to be implemented.

Ultimately, electric vehicles will be the way to go for your business, as they have undeniable advantages, but you may want to hold off a little while if you need to drive long distances daily or don’t have easy access to charging points.